What is a plant-based investor?

The term “plant-based investor” is a broad one (which is good news for companies looking for funding in this space). These investors come in a variety of forms, and have a variety of motivations for their plant-based investing – some driven by the big picture of plant-based, and some driven by the big picture of plant-based, and some aiming to mitigate the risk of putting all their eggs in a non-vegan basket. Here we take a brief look a 6 types investors:

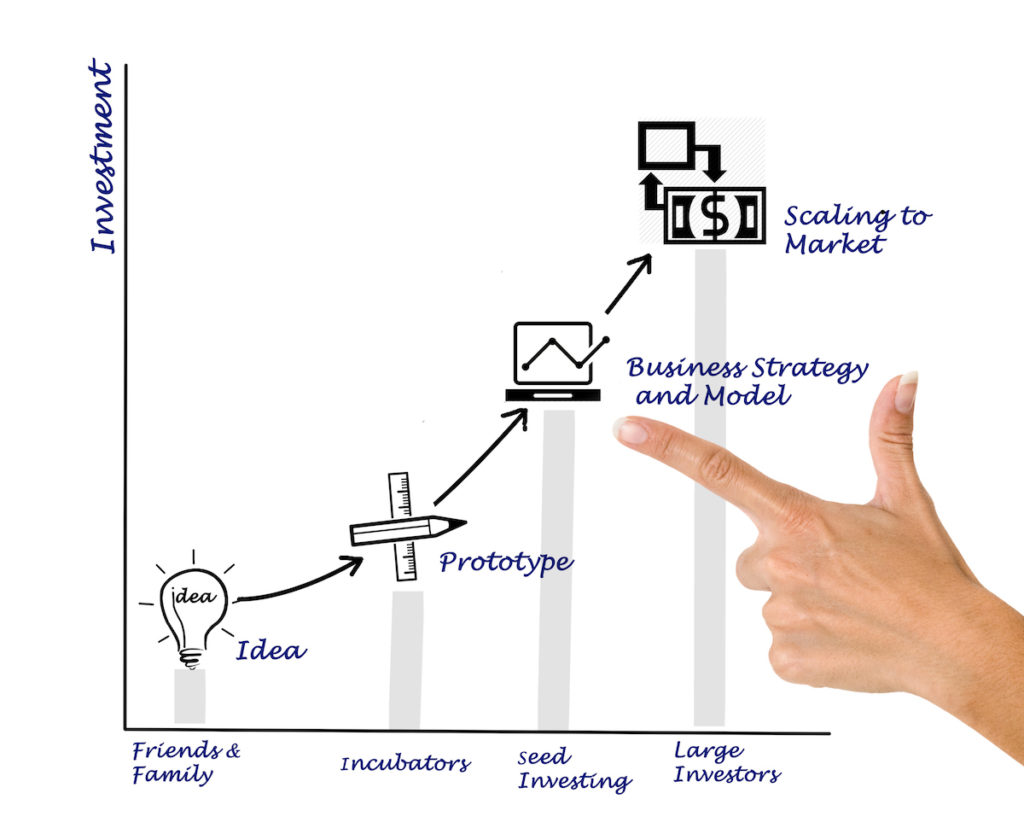

Friends & Family

Friends and family are often the source of the very first capital for startups, since they are usually willing to take more risk on a fledgling company because of their relationship with the founders. The friends and family investments are usually in the tens of thousands of dollars, or low hundreds of thousands, rather than other sources, which can be more. Raising initially from friends and family also signals to future investors (whether angels, VCs, etc.) that an entrepreneur has promise given her/his drive, passion, and ability to raise capital. This article in Forbes by author Martin Zwilling discusses that idea in more depth.

Angels

Angels are affluent investors who usually invest very early on in a startup. (Note: angels may be a subset of the group “Friends and Family”.) Angels can be expected to invest between $25,000 to $100,000. These investors, because of their early involvement in startups, stand to lose their entire investments if the startups fail early on. Angels therefore will look to see a thoughtful and defined exit strategy. Richard Harroch shares some great tips for what entrepreneurs can expect when dealing with angel investors.

Venture Capitalists

Venture capitalists frequently invest as a group, and usually have a considerable risk tolerance given the possibility of great return. Often they seek out “groundbreakers” because of the chance for tremendous return on investment if a new, innovative company really takes off. The New York Times has an excellent section on current venture capital news.

Private Equity Firms

Private equity firms manage private equity funds, which are similar to hedge funds or mutual funds. The adviser (aka “the firm”) uses the money pooled in the fund by various investors to invest on the fund’s behalf. The difference between private equity funds and mutual or hedge funds is that private equity is usually much more long term – investments made by private equity firms often have a timeline of ten or more years before they will be sold. Most private equity firms invest only in more mature companies, and are investing millions of dollars in scale-up capital or even acquiring a business outright.

Strategics (Ex. large food companies)

Strategic investors offer more than just capital to startups – they offer expertise, knowledge, and a very powerful network within the industry. Beyond that, strategics may offer benefits through their physical & logistical assets, between their manufacturing capacity, distribution capabilities, etc. Strategics can offer help in forms that are often much more valuable than capital alone. They tend to invest millions of dollars at a time and also frequently acquire companies to add to their portfolios. Strategic investors are often looking to diversify their otherwise predominantly non-vegan holdings, as a hedge against market risk or because they see the opportunity in this groundbreaking space. One example is Tyson Ventures, which now holds a 5% stake in Beyond Meat.

Family Offices

Family offices act as the investment arms of extremely high-net-worth families. Family offices may be set up to serve a single wealthy family, or multiple. The sizes and stages at which they invest vary greatly.

Mission Driven

While any of these investor-types could be what we call “mission-driven” or “mission-aligned” investors (those who opt to invest in plant-based companies because such companies align with their beliefs and worldview) it is more frequent that friends and family, angels, family offices, and certain VCs will fall into the category. One excellent group of mission-driven investors is the – The Glass Wall Syndicate which is devoted entirely to investing within the plant-based space.

Driven to grow your success

PlantBased Solutions has spent years developing deep relationships with a broad network of investors, and introduces clients to these partners as appropriate. Our introductions are strategic and based upon the specific needs and desires of each client.